Home Inspections

Home inspections, what are they looking for?

If you are asked to allow a home inspection for insurance, please do not feel you have been singled out or may pay a larger premium as a result. We strive to make certain every policy meets the needs of the insured for loss in addition to getting the lowest premium.

When you receive an insurance quote, replacement value calculation software is used by your insurance representative at American Insurance & Investment to determine the home’s replacement value. The software is very good but every property is unique in some way so the best way to validate the cost to rebuild for the homeowner is to conduct an insurance inspection.

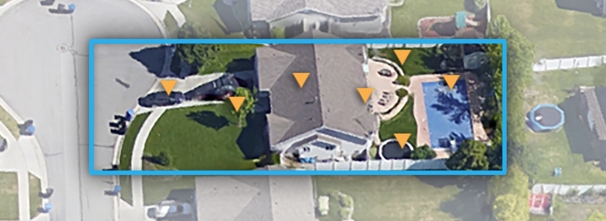

It has become more common in recent years for home insurance companies to conduct insurance inspections within 30 days of the new policy or at renewal. Many of the inspections take a look at the interior of the residence as well as the exterior.

There are two primary purposes of a home inspection:

- To validate the replacement value are calculated with a combination of public information and information you’ve provided, and,

- To identify conditions where a loss might occur: safety items such as a deck with no handrails, or susceptibility to loss, most commonly water.

The inspector will generally measure the home as sometimes property tax information is not accurate. They may also ask you questions regarding the age of the roof, furnace, electrical system, plumbing and confirm the construction type, such as true brick or masonry veneer. Along with the roof condition and shape, they will also take a look at the gutters and downspouts to see if they are all connected properly.

Estimating exposure saves you time and money as lower claim rates equal lower premiums for everyone.

|